Insurance Explained: Protecting Your Future and Financial Assets

Understanding insurance is crucial for all people who wants to secure their financial stability. It provides a safety net in case of unforeseen incidents potentially causing substantial damage. Many different forms of insurance are available, tailored to meet specific requirements. However, many individuals struggle with determining the right amount of coverage and maneuvering through policy details. The intricate nature of insurance can create uncertainty, necessitating a better grasp on how best to protect one's wealth. What factors should people weigh before committing to a policy?

Insurance 101: Essential Information

Insurance functions as a monetary safeguard, guarding individuals and enterprises against unexpected dangers. It is fundamentally a contract linking the customer and the company, in which the policyholder remits a fee to receive monetary protection in case of particular harm or loss. At its core, insurance is about handling risk, letting policyholders pass on the weight of potential financial loss to an insurer.

Coverage agreements detail the rules and stipulations, specifying the scope of protection, what limitations apply, and how to report a loss. The concept of pooling resources is central to insurance; many pay into the system, making it possible to finance payouts from those who experience losses. Understanding the basic terminology and principles is vital for sound judgment. Overall, insurance is designed to provide peace of mind, making certain that, when disaster strikes, people and companies are able to bounce back and continue to thrive.

Types of Insurance: A Detailed Summary

A myriad of insurance types exists to cater to the diverse needs of individuals and businesses. The most popular types include health coverage, that pays for healthcare costs; motor insurance, shielding against automobile harm; as well as property coverage, securing assets against hazards like burning and robbery. Life insurance offers financial security to recipients upon the death of the policyholder, while disability insurance provides income replacement should the individual be incapacitated.

For businesses, liability insurance protects from accusations of wrongdoing, while commercial property coverage protects tangible goods. Professional liability insurance, also known as errors and omissions insurance, shields professionals against lawsuits stemming from omissions in their services. Moreover, travel coverage insures against unanticipated situations while traveling. Each type of insurance is crucial for handling potential dangers, helping people and companies to reduce possible monetary damages and maintain stability in uncertain circumstances.

Assessing Your Insurance Needs: How Much Coverage Is Enough?

Establishing the correct amount of insurance coverage requires a careful evaluation of property value and possible dangers. One should review their monetary standing and the property they want to safeguard to calculate the proper insurance total. Effective risk assessment strategies play a vital role in ensuring that one is not lacking enough coverage nor paying extra for needless protection.

Evaluating Asset Value

Evaluating asset value is a necessary phase for understanding how much coverage is necessary for effective insurance protection. This step entails determining the worth of personal property, land and buildings, and investment portfolios. Homeowners should consider elements like today's market situation, the cost to rebuild, and depreciation while assessing their real estate. Also, individuals must evaluate private possessions, vehicles, and any liability risks associated with their assets. By completing a detailed inventory and assessment, they can identify areas where coverage is missing. Also, this assessment assists people tailor their insurance policies to address particular needs, guaranteeing sufficient coverage from unanticipated incidents. In the end, precisely assessing asset worth establishes the groundwork for smart coverage choices and economic safety.

Approaches to Risk Analysis

Developing a full knowledge of property valuation automatically moves to the next phase: evaluating insurance needs. Risk evaluation techniques entail pinpointing possible hazards and figuring out the right degree of insurance required to mitigate those risks. The evaluation commences with a detailed inventory of assets, including property, vehicles, and personal belongings, alongside an analysis of potential liabilities. The individual must consider things such as location, daily habits, and risks relevant to their profession which might affect their need for coverage. Additionally, checking existing coverage and identifying gaps in coverage is crucial. By quantifying risks and aligning them with the value of assets, you can make educated choices about the level and kind of coverage needed to safeguard their future effectively.

Grasping Policy Language: Core Principles Defined

Understanding policy terms is vital for navigating the intricacies of insurance. Core ideas like types of coverage, insurance costs, deductibles, exclusions, and limitations are critical factors in determining the effectiveness of a policy. A solid understanding of these terms helps individuals make informed decisions when choosing coverage plans.

Types of Coverage Defined

Insurance plans include a range of coverage categories, all created to handle specific risks and needs. Typical categories involve coverage for liability, which guards against lawsuits; coverage for property, safeguarding physical assets; and personal injury coverage, which covers harm suffered by others on one’s property. Moreover, extensive coverage offers protection against a broad spectrum of dangers, including theft and natural disasters. Specialized coverages, like professional liability coverage for companies and medical coverage for people, further tailor protection. Understanding these types assists clients in selecting appropriate protection based on their unique circumstances, guaranteeing sufficient security against future fiscal setbacks. Each coverage type plays a critical role in a broad insurance approach, leading to fiscal stability and tranquility.

Cost of Coverage and Deductible Amounts

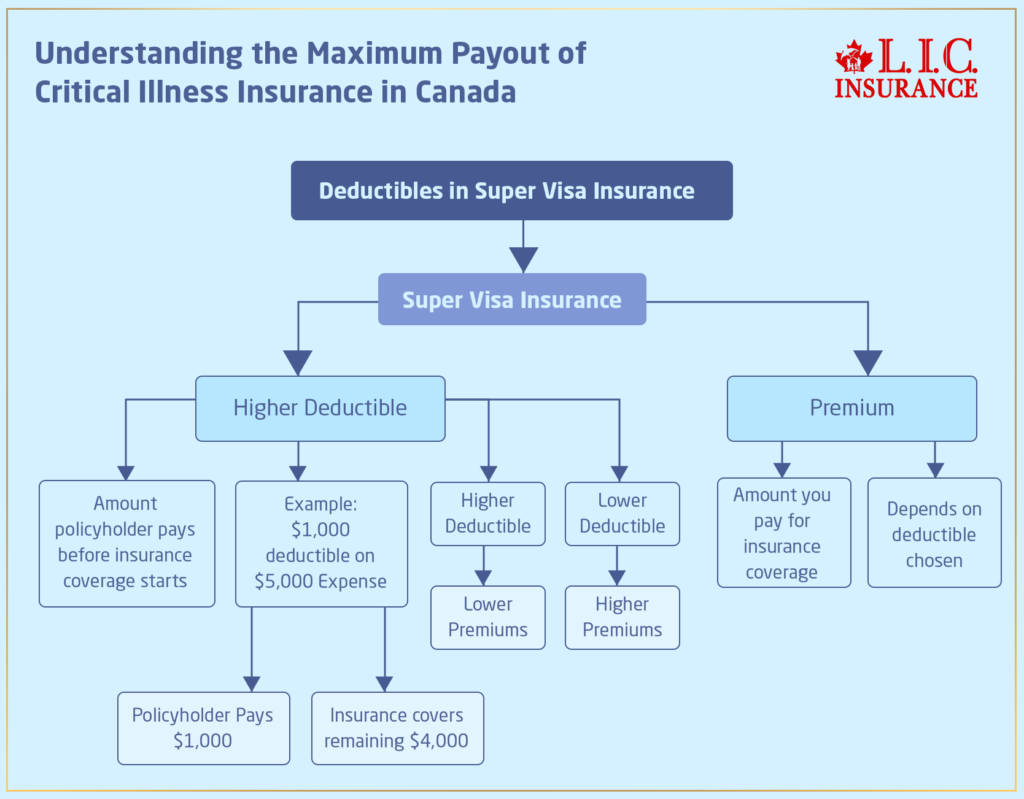

Selecting the right coverage types is just one aspect of the insurance puzzle; the financial components of premiums and deductibles significantly impact coverage choices. Premiums are the expense associated with keeping an insurance policy, usually remitted yearly or every month. A greater premium often indicates broader protection or smaller deductible amounts. In contrast, deductibles are the figures clients are required to pay themselves before their policy protection activates. Opting for a greater deductible can lower premium costs, but it could result in more fiscal liability during claims. Understanding the balance between these two elements is vital for those aiming to protect their assets while controlling their spending wisely. Crucially, the interaction of the costs and payouts determines the overall value of an insurance policy.

Limitations and Exclusions

Which components that can limit the effectiveness of an insurance policy? The fine print within a policy define the circumstances under which coverage is denied. Typical exclusions include pre-existing conditions, war-related incidents, and certain types of natural disasters. Restrictions can also pertain to specific coverage amounts, necessitating that policyholders grasp these restrictions thoroughly. These elements can considerably affect claims, as they determine what financial setbacks will not be paid for. Insured parties need to review their insurance contracts closely to identify these exclusions and limitations, making sure they fully understand about the extent of their coverage. Proper understanding of these terms is vital for effective asset protection and long-term financial stability.

The Claims Process: What to Expect When Filing

Submitting a claim can often be confusing, especially for those unfamiliar with the process. The first stage typically involves notifying the insurance company of the incident. This can usually be done through a telephone call or digital platform. When the claim is submitted, an adjuster may be assigned to assess the situation. This adjuster will examine the specifics, gather necessary documentation, and may even go to the incident site.

Once the review is complete, the insurer will verify the authenticity of the claim and the amount payable, based on the contract stipulations. Policyholders must usually supply supporting evidence, such as photographs or receipts, to aid in this assessment. Staying in touch is vital throughout this process; the insured might need to check in with the insurer for updates. A clear grasp of the claims process enables policyholders to handle their rights and responsibilities, ensuring they receive the compensation they deserve in a prompt fashion.

How to Pick the Right Insurance Provider

How does one find the ideal insurance provider for their needs? To begin, they need to determine their unique necessities, looking at aspects full information such as policy varieties and spending restrictions. Conducting thorough research is essential; internet testimonials, scores, and client feedback can provide information about customer satisfaction and how good the service is. Furthermore, getting estimates from several insurers makes it possible to contrast premiums and policy details.

It is also advisable to evaluate the economic strength and reputation of potential insurers, as this can impact their ability to fulfill claims. Talking with insurance professionals can help explain the policy's rules, ensuring transparency. Furthermore, checking for any discounts or bundled services can improve the total benefit. Lastly, getting suggestions from people you trust may result in finding reliable options. By following these steps, people are able to choose wisely that are consistent with their insurance needs and budgetary aims.

Staying Informed: Ensuring Your Policy Stays Relevant

After selecting the right insurance provider, policyholders should be attentive about their coverage to guarantee it meets their changing requirements. It is crucial to check policy specifics often, as major life events—such as tying the knot, buying a house, or job changes—can affect what coverage is needed. People ought to arrange yearly meetings with their insurance agents to discuss potential adjustments based on these personal milestones.

In addition, staying informed about industry trends and shifts in policy rules can give helpful perspectives. This information might uncover new insurance possibilities or savings that could enhance their policies.

Monitoring the market for competitive rates may also lead to more cost-effective solutions without sacrificing protection.

Frequently Asked Questions

In What Ways Do Insurance Costs Change With Age and Location?

Insurance premiums usually rise as one gets older due to greater potential hazards associated with senior policyholders. Furthermore, location impacts rates, as urban areas often experience higher premiums due to more risk from crashes and stealing compared to non-urban locations.

Am I allowed to alter my current insurer Mid-Policy?

Yes, individuals can change their insurer during the policy term, but they must review the terms of their existing coverage and make certain new coverage is established to avoid gaps in protection or potential penalties.

What Happens if I Miss a insurance installment?

Should a person fail to make a premium payment, their protection could cease, resulting in a possible lack of coverage. Reinstatement might be possible, but it might demand retroactive payments and may involve penalties or increased premiums.

Will existing health problems be covered in Health Insurance?

Pre-existing conditions may be covered in medical coverage, but the inclusion depends on the specific plan. Many insurers impose waiting periods or exclusions, though some grant coverage right away, emphasizing the importance of reviewing policy details thoroughly.

In what way do deductibles influence the cost of my coverage?

The deductible influences coverage expenses by setting the sum a covered individual has to pay personally prior to the insurance taking effect. A larger deductible generally means reduced monthly payments, whereas smaller deductibles result in increased premiums and potentially less out-of-pocket expense.